Cashing In On Chips: Semiconductor Stocks Beyond The Hype

Reviewed by Michael Paige, Bailey Pemberton

Quote of the Week: "If you'd asked me in 1980 what the big impact of microprocessors would be, I probably would have missed the PC. If you asked me in 1990 what was important, I probably would have missed the Internet." - Gordon Moore

Recently, most of the leading semiconductor stocks have traded lower. Notably, Micron Technology reported quarterly EPS and revenue ahead of consensus and reaffirmed its guidance, only to have the share price fall 10%.

Some chip stocks seem to be priced for perfection, and good just isn’t good enough.

So we thought it fitting to do a deeper dive into the semiconductor industry for two reasons. Firstly, because it seems everyone, including your neighbour’s dog, is talking about it these days (yet they may not fully understand it), and secondly, the current market and economy are so tied to the industry that it pays to know where we might be in the cycle to avoid trouble and find opportunities.

With Q2 earnings season starting soon, the biggest customers in the chip market (Microsoft, Alphabet etc.) will be reporting, and we will get an idea of how much they spent in the last 90 days. Then the chipmakers themselves will report, and we’ll get an even better idea of the strength of the current spending boom.

So to get you prepared for those summer barbeque chats (for those of you in the Northern Hemisphere ) we’re going to break down the types of chips, the different types of companies, and the key players in this industry that spans the globe and powers just about every growing industry.

We are starting this week with a brief overview of the industry and a look at the memory chip industry.

Let's dive in!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🍔 McDonald’s Says McPlant Burger Test Failed ( The New York Post )

- What’s our take?

- The people have spoken, and they want meat on their burgers. This is more of a problem for Beyond Meat than it is for McDonald’s since they were just running an experiment, while Beyond Meat is reliant on these kinds of partnerships. Analysts are attributing Beyond Meat’s huge share price decline over the last few years to “soaring inflation and cratering demand for non-animal protein”. Regardless, McDonald’s is moving on from plant-based burgers and trying its luck with affordable $5 combo meals, and Beyond Meat will have to try its best to remain solvent given its cash burn continues and its cash pile dwindles.

- What’s our take?

-

📺 YouTube TV loses subscribers for first time ( Variety )

- What’s our take?

- If you have to offer a cable-like service, you may suffer a cable-like fate. YouTube TV, which offers major broadcast and popular cable networks, experienced in Q1 what most traditional linear networks have for years - a decline in subscribers. According to Variety, the ending of the NFL season in Q1, plus the lack of must-watch linear TV content, is taking its toll on both traditional TV and virtual pay TV. It may be a case like any streaming business where users jump in and out as they want for different seasons, but in this case, YouTube TV is $73 per month, whereas streaming platforms are in the $15-20 range, so value for money would be a huge factor here.

- What’s our take?

-

📉 Nike Receives A Slew Of Downgrades As It Faces Fierce Competition ( Yahoo Finance )

- What’s our take?

- Change is the only constant, and many big-name athleisure brands are facing their fair share of serious competitors these days. Nike and Adidas are seeing ASICS, New Balance, ON, and Hoka gain more traction in the sneaker space, while the likes of Lululemon are seeing Alo and Vuori step up to the plate . While it’s too early to tell, and some companies have tough comparable periods given the strong sales growth in the past, some of the big players are having their market share chipped away. It’s important to remember that consumer preferences are constantly evolving and that brands, no matter how good they are, can’t rest on their laurels.

- What’s our take?

-

🤖 Investors Underwhelmed by Micron For Not Meeting Lofty AI Expectations ( Reuters )

- What’s our take?

- When expectations are high, so too are the downside risks. Despite beating estimates for Q3 revenue, and providing Q4 guidance for revenue growth 90% over the prior year, (yes, 90%), this wasn’t as much as the market was expecting. As one analyst noted, “ Anything less than fantastic is not good enough when your share price multiplies by 3 in just 18 months ”. However, while investors sold the stock off, analysts were still bullish and increased their price targets, as you can see on section 1.7 of Micron’s company report. They saw the share price dip as a chance to add more to their positions.

- What’s our take?

-

🥷 Big Tech Using “Reverse Acquihires” To Avoid Scrutiny ( The Verge )

- What’s our take?

- It’s essentially a pseudo-acquisition, and this probably won’t go unaddressed by the antitrust regulators forever. The likes of Microsoft and Amazon have been doing what’s called “ reverse acquihires ”, where, rather than acquiring a company outright and having to get approval from regulators to do so, they simply hire the vast majority of the staff at a target company and pay a hefty “licensing deal” to sell their models on their platform. The target company then becomes a shell of itself, and uses the funds to return some capital to shareholders, while Microsoft or Amazon retain their staff and the models. It sounds like an acquisition if you ask us, and the regulators might think so too eventually, so Big Tech may not be able to pull this off forever.

- What’s our take?

-

Podcast: The Six Billion Dollar Gold Scam ( BBC )

- What’s our take?

- Bre-X was a Canadian gold mining company that struck gold in 1995 when it announced the discovery of the world’s largest gold reserve in Indonesia. The share price soared from $0.20 to $286, giving the company a CAD $6 billion valuation. That was until it emerged that the entire thing was a fraud, and there was no gold! None whatsoever!

- This podcast series is worth a listen if you’d like to know how a fraud can unfold, and how easily investors - including more than one pension fund - were fooled by a good story. It’s particularly relevant to anyone investing in speculative penny stocks.

- What’s our take?

📖 An Introduction to the Semiconductor Industry

Question: What do artificial intelligence, automation, the metaverse, fintech, the electrification of the economy, the internet of things , blockchains, healthtech, EVs, cloud computing, mobile commerce, and cybersecurity have in common?

Answer: They cannot happen without tiny components made of silicon, aka microchips and integrated circuits.

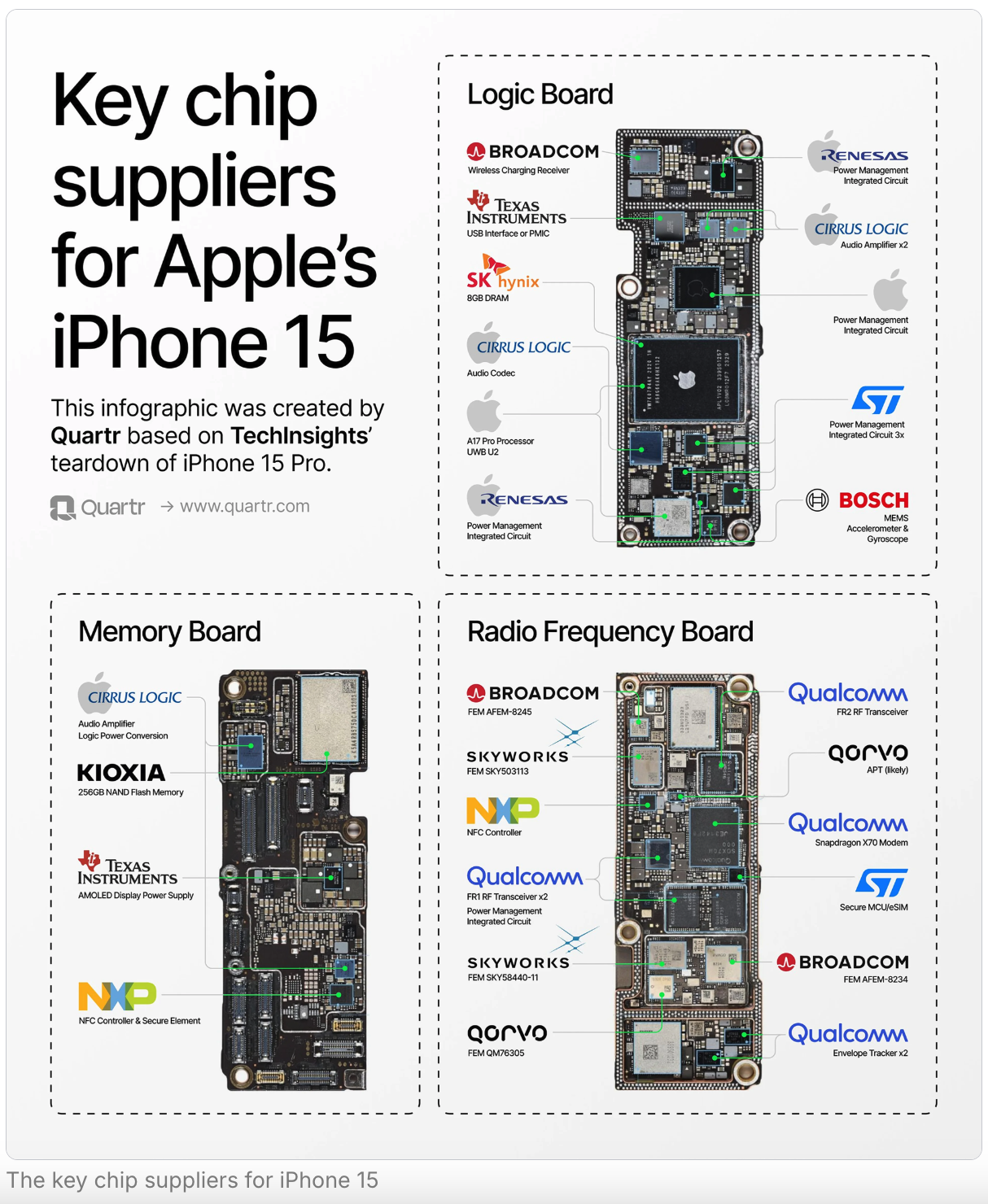

Pretty much every major growth industry and secular trend (we left out a few) relies on microprocessors and other semiconductor components. This graphic from Quartr shows us just how many components go into an iPhone, and who makes them:

Beyond the excitement and hype surrounding AI chips, the semiconductor industry is massive and complex. For investors, it does take time to properly research and understand the companies, but there are three very good reasons to do so:

- 📈 Firstly, it's crucial to all those long-term secular trends. That means winning investments can compound for decades.

- 💽 Secondly, designing and manufacturing chips is very difficult . That allows the winners to develop very wide moats, as Nvidia , TSMC and ASML have done.

- 🌀Finally, the industry is far more cyclical than other tech industries. This gives savvy investors a chance to invest at very reasonable valuations.

🧑💻 A Quick Primer on the Industry

Before we look at the companies that make up the semiconductor industry, here’s a quick overview of the types of chips they make and the broader industry - along with some of the jargon that’s going to come up later.

Silicon’s conductive properties give it widespread applications including the production of solar panels and display screens for mobile phones, computers and televisions. But the term semiconductors is usually used to refer to microchips.

A microchip is an integrated circuit (IC) consisting of:

- Transistors - which act as switches or amplifiers and control the flow of electrical current;

- Resistors and Capacitors - which regulate the current and voltage;

- And other components.

These components are etched into silicon at a scale that now allows smartphone chips to contain 10’s of billions of transistors.

Microchips are used to store and process data in various ways. If you're keen to know how they actually work, this video does a pretty good job of explaining that in three minutes.

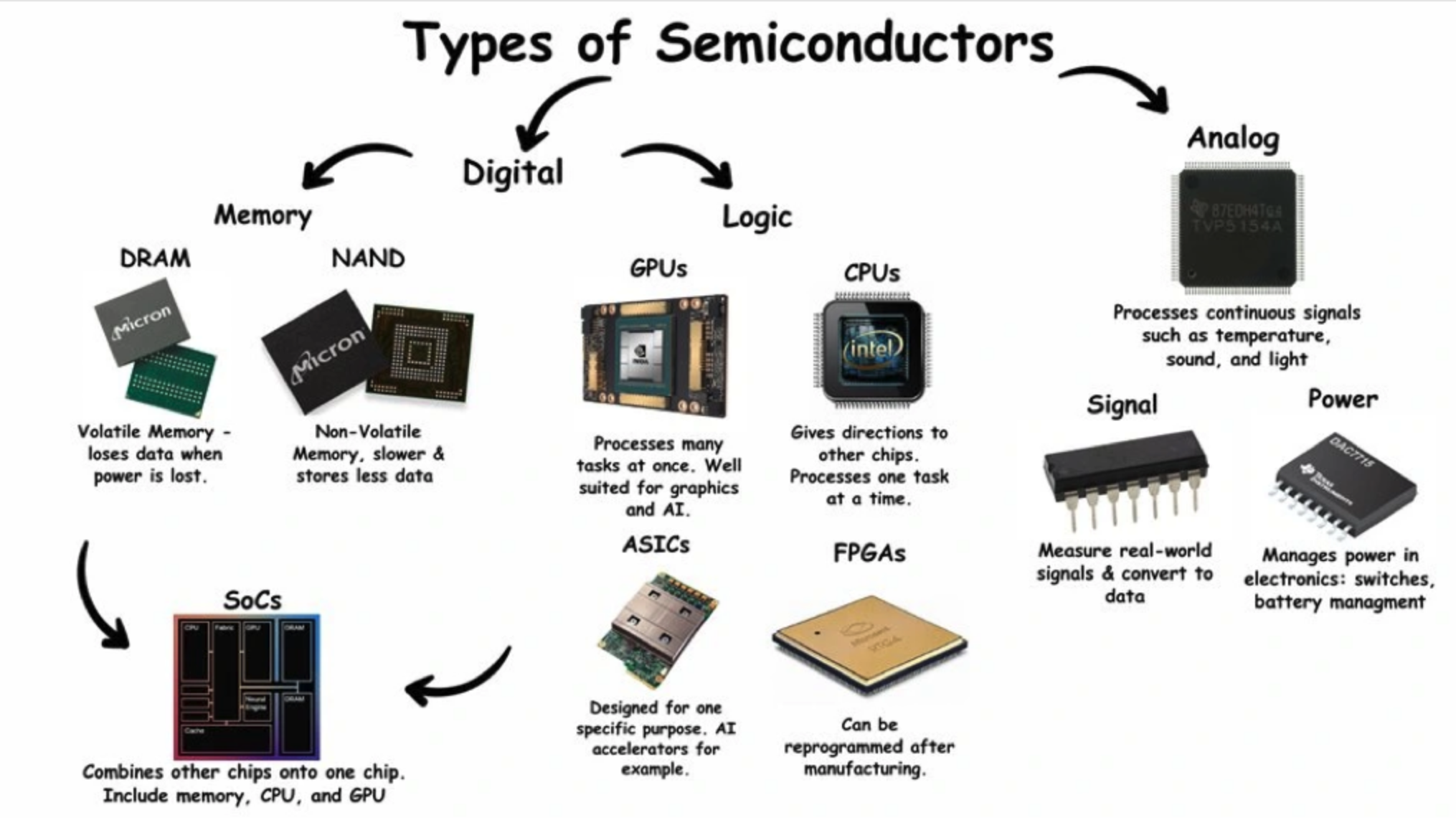

Chips are generally divided into three groups:

- 💾 Memory chips store data - e.g. the chip in a USB flash drive.

- 💻 Logic chips process data - e.g. CPUs and GPUs.

- ⚡ Analog chips control power and convert analog signals like sound and temperature into digital data. - e.g. the microphone in your phone.

Some chips perform just one function, but components are usually combined or ‘packaged’ for specific use cases and tasks:

-

Microcontrollers perform specialized tasks that are used to control electronic devices.

-

Microprocessors are more powerful and can perform a wide range of tasks.

- CPUs (central processing units) can perform a variety of tasks, but only perform one task at a time.

- GPUs (graphics processing units) can perform a narrower range of tasks but can perform more than one task at a time.

-

CICs (commodity integrated circuits) are lower-cost chips that are used for specific or general purposes.

- FPGAs (field-programmable gate array) can be modified by manufacturers after they are produced. FPGAs are widely used in the production of connected devices.

- ASICs (application-specific integrated chips) are designed to perform specific, repetitive tasks. These are used for Bitcoin mining.

-

SoCs (system on a chip) combine various types of chips into one chip. These are commonly used to power mobile phones.

-

Embedded devices are devices that perform a specific function within larger devices, like computer systems in cars, traffic lights, ATMs, Point of Sale (POS) systems, etc.

Chips are manufactured in fabrication facilities, known as fabs. Fabrication of chips is difficult and capital-intensive, which has resulted in many companies choosing to outsource production and focus on design and marketing. These companies are known as fabless chipmakers.

Only a handful of companies still manufacture chips, with TSMC dominating this industry. The companies that still design and fabricate chips are known as integrated device manufacturers (IDMs), and include Intel , Samsung and Micron .

The design and manufacturing of chips is supported by a huge ecosystem of companies that provide the software used to design and test chips, incredibly expensive equipment used to produce and then package the finished product - and of course, all the raw materials used throughout the process.

🧠 Memory Chips

As the world produces, processes and consumes data at an ever-increasing rate, PCs, Mobile phones and data centers need somewhere to store that growing mountain of data. Artificial intelligence models also rely on rapid access to that data, meaning memory chips might be one of the overlooked parts of the AI arms race.

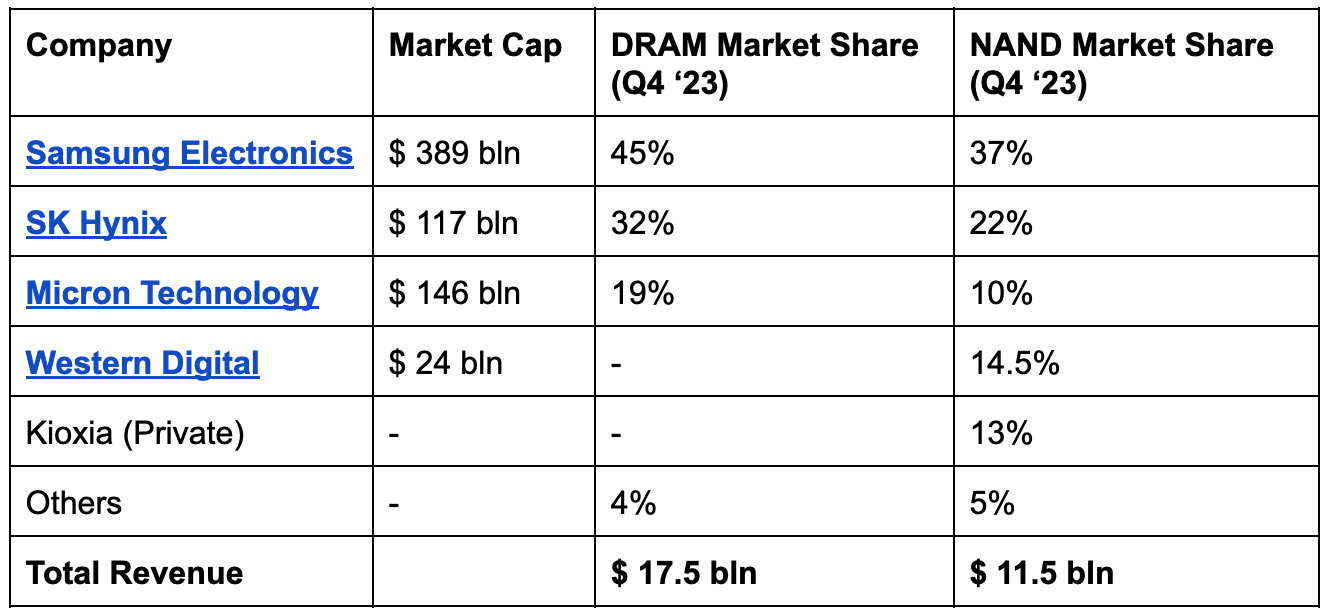

✨ The memory chip market is fiercely competitive and is dominated by a small number of firms. Samsung , SK Hynix , and Micron Technology account for 96% of the DRAM market. The same three companies along with Western Digital and Kioxia account for 95% of the NAND market.

Samsung leads in both markets, but memory is a fairly small part of the much bigger empire. Nevertheless, it has contributed to a big jump in earnings in the last year.

NAND Flash memory

Flash memory is non-volatile memory, meaning it can retain data without power. This is the memory that stores data and program files on a PC or mobile phone. This is the type of memory found in USB flash drives and memory cards.

Non-volatile memory is essential to any computing system, but has some limitations, including speed.

DRAM memory

Dynamic Random-access Memory can only store memory when it's powered. However, it is faster than NAND memory, so it's better suited for processing data.

HBM (high-bandwidth memory) combines stacked DRAM chips with an interface to increase the speed and volume at which data can be accessed. HBM is used with high-performance processors like GPUs and AI accelerators. This is a small but rapidly growing part of the memory chip market.

Memory Chip Market Share Q4 2023 - Trendforce

✨ The market for memory chips is the most cyclical in the industry. Memory chips are very much a commodity, and prices and volumes are a function of supply and demand. In addition, prices fall over time while volumes increase over time. The cost of DRAM (per gigabyte) has fallen by about 26% each year since 1990. But the amount of data the world generates, stores and processes is increasing at an even faster rate.

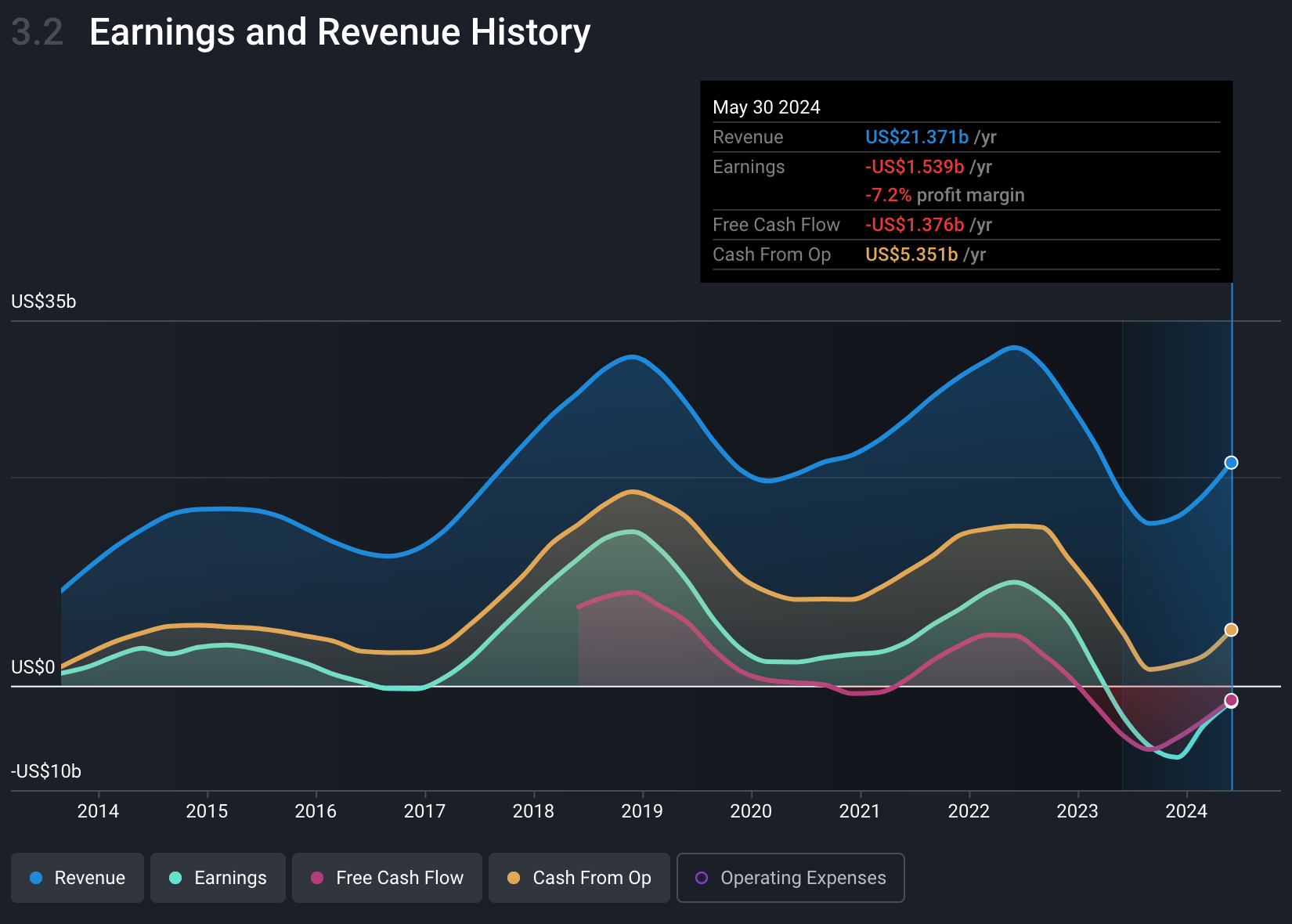

Demand is also affected by replacement cycles for devices and new product releases at each stage of the supply chain. So while prices fall and volumes rise over time, that doesn’t happen in a straight line. The chart below illustrates just how cyclical Micron’s revenue and earnings can be, and the fact that negative earnings and cash flows can be a reality.

💡 The Insight: Make Sure You Understand R&D And CapEx cycles

Memory chips might be a commodity, but designing and manufacturing chips is very different from growing corn or wheat (no offense to the farmers out there). Chipmakers have to spend vast amounts on research and development and capital expenditure to remain competitive.

For fabless chip companies, most of the investment goes to R&D. Chipmakers that design and manufacture chips need to invest in both. In 2023 Micron spent $3.1 billion (20% of revenue) on R&D, and $7.7 billion (49% of revenue) on capital expenditure.

These investments have just as much impact on earnings and cash flow as sales. They are also necessary to ensure future profitability.

The way R&D and CapEx are accounted for is very different and usually goes a long way to explain the gap between earnings and free cash flow:

- 🥼 Research and Development is an expense and includes salaries and fees for services used to develop new products. R&D falls under operating expenses, which are subtracted from gross profit to arrive at the operating profit and net income, or earnings. So higher R&D spending leads to lower earnings in the same period.

- 🏭 Capital expenditure includes investment in equipment and other assets. These investments don’t appear on the income statement immediately, so they don’t affect earnings in the current period. But they do appear on the cash flow statement, and result in lower free cash flow. These investments are also recorded as fixed assets on the balance sheet, and then depreciated over several years. Depreciation is recorded as a non-cash expense on the income statement.

The bottom line is that R&D spend immediately reduces earnings, while Capex is gradually deducted from earnings in the form of depreciation.

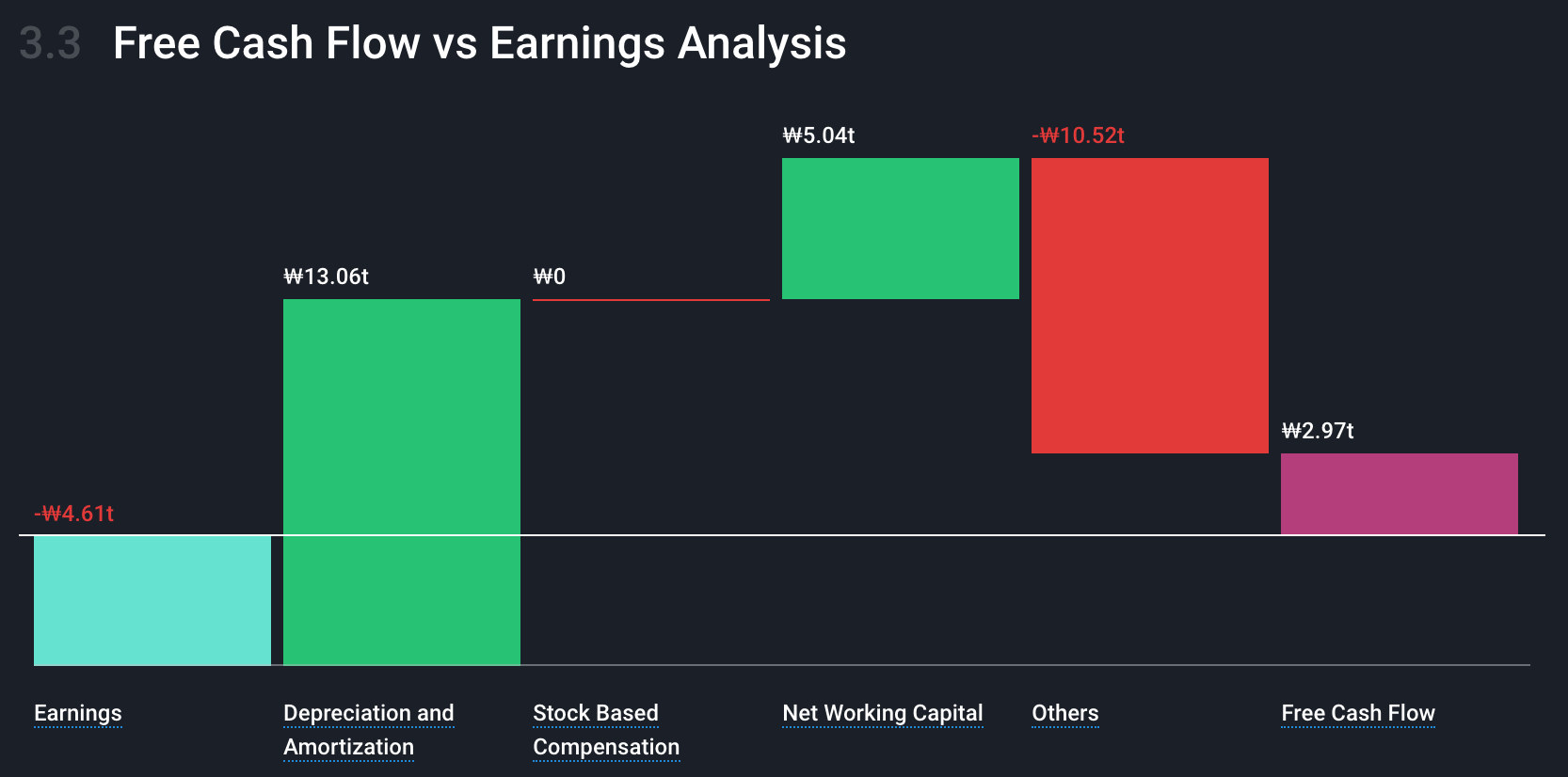

Section 3.3 of each company report on the Simply Wall St platform reconciles the difference between earnings and free cash flow.

The graphic above reconciles SK Hynix’s negative earnings with its positive free cash flow for the 12 months to March. In this case, the loss was mostly due to a large depreciation expense, which was offset by Capex, and falls within the red bar labelled ‘Other’.

Key Events During The Next Week

There were a few mixed signals last week, as job openings rose unexpectedly, while business activity in the services sector fell sharply. US inflation data later in the week may provide some clarity…

Tuesday

-

🇦🇺 In Australia, the Westpac Consumer Confidence and NAB Business Confidence Indexes will be published. Both indicators are forecast to fall slightly.

-

🇺🇸 US Fed Chair Jerome Powell will testify before Congress.

Thursday

- 🇬🇧 UK GDP data is due to be published. The economy is forecast to have grown 0.1% in May after stalling in April.

- 🇺🇸 US CPI data will be released. The annual inflation rate is expected to be 3.1%, down from 3.3% in May. The core inflation rate is expected to fall from 3.4% to 3.2%.

Friday

- 🇺🇸 US PPI is forecast to show producer prices rising 0.2% in June, after falling in May.

Second quarter earnings season starts on Friday with the first of the big banks reporting:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.