Announcement on 01 May, 2024

Valuation Upgrade: Google Demonstrated Continuous Growth, Accelerated Profitability, And AI Risk Management

- Google's Q1’24 revenue increased to $80.5B up 15%, indicating a reacceleration of their core advertising business. This brings Google’s TTM growth up to 11.8%, close to my 10% annual growth expectations.

- Operating income in Google's cloud business jumped to $900M, showing sizable profits in the division for the first time. The company managed to scale their trailing 12-month net margin to 25.9%, ahead of my 20% expectations. This is the second time Google managed to elevate profitability above 25% after 2020, if margins are kept stable, I will upgrade my profitability assumptions.

- The company’s new $0.2 quarterly dividend policy indicates a baseline stabilization of returns to investors, but has no impact on value. Going forward, the company authorized up to an additional $70B buybacks, above the $62.6B spent on buybacks in the last 12-months. The confidence to increase buybacks may be interpreted as a positive signal from investors. The difference between the buybacks and net profit is part of the reason why I’m not upgrading my valuation.

- Google is focusing on AI and Search for its business strategy and has made progress in developing its Gemini model, demonstrating improvements in long-context understanding and multimodal capabilities. Google is seeing increased user satisfaction and engagement with its AI features in Search.

- The company is confident that it can manage the cost of serving generative AI queries and monetize them effectively. Google is increasing its capital expenditures to support its growth in AI and Cloud. They have spent $12B in Q1’24 and expect capex to be at this level or higher in the next quarter. The main KPI to watch for is the profitability increases in search, as most of the AI investments should be reflected in higher search monetization.

- Sundar Pichai expects YouTube and Cloud to exit 2024 at a combined annual run rate of over $100B, while noting that shorts have 70 billion daily views and the number of channels creating Shorts increased by 50% YoY . The $100B YT + Cloud 2024 exit implies a 55% growth from the $64.6B in FY‘23.

- Google had an outstanding quarter with increased profitability and upbeat expectations for the Cloud and YouTube performance. The company invests large amounts of capex that are increasing their yield across segments. Google has managed to accelerate growth and reduce the risks associated with its bottom line. Because of this, I am increasing my estimate for the forward PE to 25x for 2028, and will keep monitoring the growth performance before changing the bottom-line assumptions.

- Given this, my new forward value is $2.3T or $203 per share. Discounting back using the Simply Wall St rate of 7.1%, I get a present value of $145 per share or $1.64T.

Key Takeaways

- Alphabet has challenges in its search business unaccounted for by investors

- Alphabet’s best bet is to focus on the Cloud, but it’s an uphill battle

- AI will contribute to revenue growth, but profitability may come later

- Cloud and AI industries to grow, but analysts may have extrapolated too much

Catalysts

Company Catalysts

AI Moat Lies In Proprietary Data Not Models

A leaked Google internal memo outlines some controversial thinking inside the company. The anonymous employee argues that smaller peers are rapidly producing Large Language Models (LLM) models that can yield comparable results to Bard and GPT-4, with the added benefit of being cheaper to produce.

In my opinion this is expected from emerging technologies as rapid iterations produce better results at lower costs. In his view, data quality seems to scale better than data size, and companies that are training niche models may come out ahead. For this reason, it is my concern that there will be no vastly superior models in the near future, but that Google’s moat lies in its large proprietary data as well as in its ability to train on processed and current data.

Data Depreciates i.e. Becomes Useless Over Time

There is always evergreen data such as a body of literature, but this is mostly public and smaller peers will be able to easily access it. The valuable data for tech companies today lies in an individual’s psychographic characteristics, demographics, and socioeconomic properties - all of which have been clustered, commoditized, and used to create models that maximize for a certain response such as: conversion, engagement, emotional appeal etc.

With this data, a customer relationship model (CRM) can produce appealing sales emails for a target customer; an AI assistant can communicate and execute tasks with less friction; a brand can micro-target individuals with a flurry of tailored content, and so on.

While this data has been incredibly useful over the last decade for businesses like Google, there are at least three hurdles to Google dominating on this avenue:

- Government protection and regulation - arguably the weakest obstacle and one that tends to arrive significantly late. The United States hasn’t implemented much regulation around AI yet, but the E.U. has already passsed AI regulation.

- A counter-AI arms race that seeks to identify AI content and provide tools that shield individuals from its influence - similar to the antivirus race in the early software years.

- The change in individuals’ behavior and traits - this is where depreciation comes in. As users adapt their relevant characteristics, Google needs to gather new data while the old stored data loses relevance i.e. depreciates. It stands to reason that behavior is always changing, and having current data becomes more important than having large sets of it. The challenge for Google is that smaller peers are now equipped with accessible data gathering resources like cloud databases, scrapers, and analytics tools. This makes it easier for them to gather proprietary data and reduce their reliance on Google’s services, which diminishes Google's competitive edge. The peers that stand to benefit the most from this are those that are interacting with their users online, such as e-commerce stores (target customers within their internal search), software businesses (optimize SEO with A/B testing, build mailing lists) and technology businesses (scrape and analyze public data). Some companies that help users leverage their own data include: Databricks, Snowflake (SNOW), MongoDB (MDB), HubSpot (HUBS), Salesforce (CRM), Datadog (DDOG), Elastic NV (ESTC), Palantir (PLTR), etc.

Google Doesn’t Have A First or Last Mover Advantage

The benefit of moving first in the AI race is gaining massive, and hopefully sticky, market share. The benefit of moving last is adopting best practices from the competition and producing at a fraction of the cost. The problem with Google is that it's neither. Before launching an experimental version of Bard on the 13th of July 2023, it had been sitting on its allegedly superior AI tech for so long that everyone used Microsoft’s and OpenAI’s products while they sat on the sidelines.

The later a company moves on AI, the better it needs to be in order to differentiate from peers. Even with the power of Google, once it fully launches, Bard may be underwhelming relative to the built-up expectations and in light of the alternatives. Before the company has a chance to optimize processes, it may have to pay a high $6B to $12B annual premium to maintain Bard. Further, taking too long to iterate may create a relevance problem where Bard has a hard time keeping up with the rapid progress that is happening from small and large peers at the moment.

Should the project succeed, one early estimate is that Bard will reach 1 billion users by 2025. Given the annual cost calculation of $12B, it will cost the company $12 per user in order to break even on Bard’s gross margin, not to mention paying for the headcount in innovation & marketing.

In the first months of granting public access, Bard hit 30 million visits. Comparatively, ChatGPT recorded 1.6 billion visits in March 2023. Shortly after launch, ChatGPT marked 616 million users in January, and 1 billion users in February. However, despite the jump statistics which are early, the more telling indicator is that ChatGPT users spend an average of 8 minutes and 44 seconds, while Bard’s average is 3 minutes and 19 seconds (as of July 2023). This quality of engagement, may be more informative of the long-term stickiness from each competitor.

It is also worth noting that Microsoft is priming for business monetization of Copilot within Microsoft 365 and floating a monthly subscription point of $30 per user on top of the current pricing. In contrast, Google is still validating its product for mass adoption.

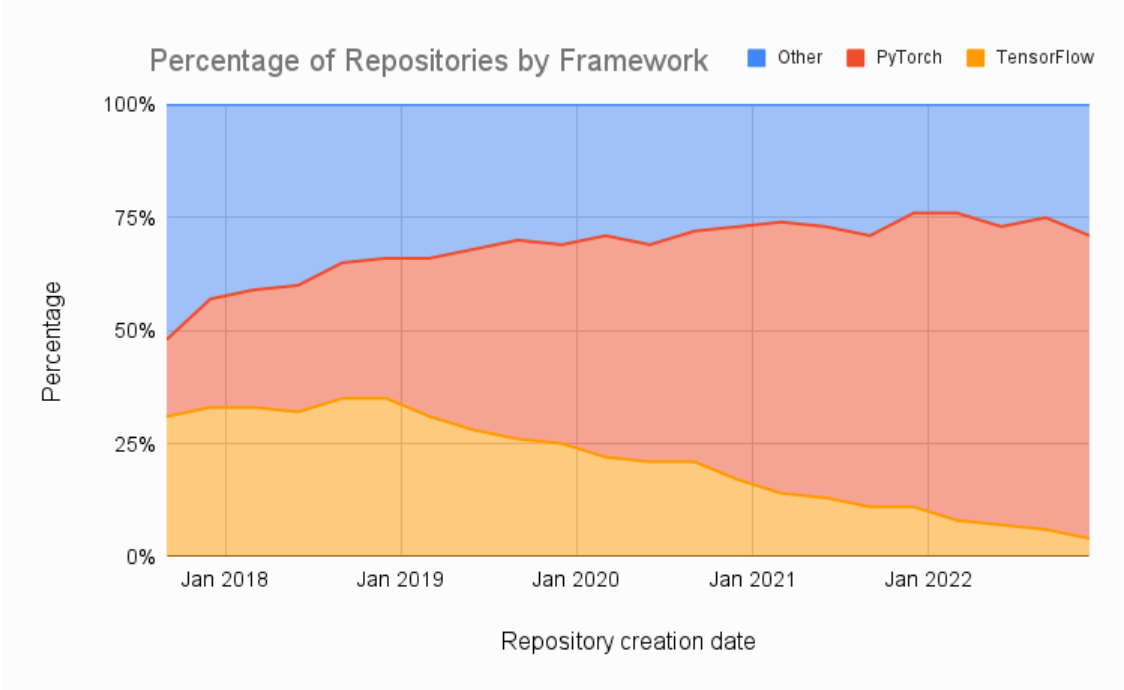

There have been similar races between first and last movers in the past. Perhaps the most relevant is the recent competition in AI machine learning platforms for developers. Initially, TensorFlow by Google was in the lead among deep learning AI researchers, but after deploying a more developer friendly framework that runs on Python, Meta’s PyTorch is taking the lead (1, 2) for AI researchers.

AssemblyAI: Percentage of Repositories by Framework

Both platforms run on open source, but PyTorch has a faster time to production, is gaining traction, and is optimized for AMD’s more affordable chipsets. The takeaway here is that it matters when a company is making the move in an innovation race. The first movers take the most market share and dictate terms, last movers utilize lessons learned and can offer the affordable solution, but Google seems to be struggling on where it’s positioning Bard, and it seems more likely than not that it may end up like its productivity suite - a widely used product with failed monetization.

Google Has Failed To Monetize Its Productivity Suite

After it became apparent that Microsoft would dominate office productivity applications two decades ago, Google took an alternative approach to the business by building base office apps for free and monetizing add-ons via their marketplace. The goal was to let entrepreneurs figure out what is worth building and monetize a cut from subscriptions. Unfortunately, this approach hasn’t yielded the anticipated innovation and monetization, as most users are satisfied with the core free functionalities. For its paid plan, Google managed to reach 9 million customers, as opposed to the 345 million customers for Microsoft 365 suite.

It is clear that Google’s approach lags behind Microsoft in core and add-on monetization. Microsoft has been successful in capturing large enterprise clients and is now attempting to make these customers even more sticky by increasing the appeal of Teams and offering integration with their customer relationship management software. Finally, Microsoft is priced competitively enough that the cost of switching to Google outweighs the benefits - so Google reps will have a harder time enticing new and existing customers to use their paid workplace apps.

Google’s Journey In Retail Has A Weak Track-Record

Google aims to integrate shopping directly into YouTube by allowing creators to list their merchandise on their channel. Over 100,000 creators are now included in the program, which could yield additional monetization avenues in the future.

Unfortunately, Google had little success with similar projects in the past, notably, Google Sites and Google My Business was created with the intention to help sellers list their merchandise on Google’s infrastructure, which in turn would enable Google to retain more of the web market share and serve ads when users searched for the sites.

This branch has since dried up, with Google My Business being partly deprecated, and Google Sites seeing miniscule development over the years. Peers like Shopify, WordPress, Amazon and AliExpress now operate the largest stores on the internet and have their own internal search that customers are directly accessing without first going to http://google.com .

Fracturing Google Search

Google still generates close to 78% of its revenues from Advertising, including Google Search, YouTube, and the Google Network. Conversely, Google Services revenue, including advertising has been flat at -0.2% YoY.

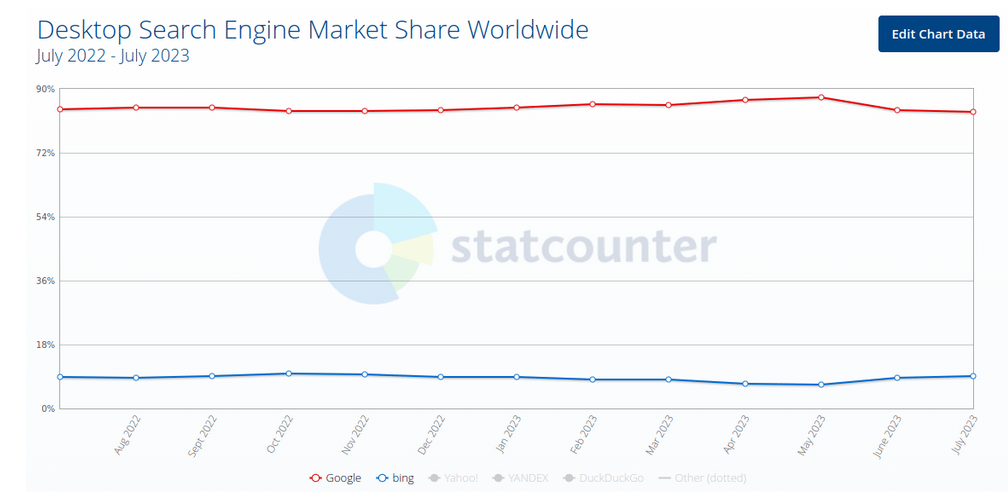

There are two key reasons for this: one is that advertisers have reduced activity due to cost cutting initiatives related to fears of an economic slowdown, and the second, is the reuptake of Bing as a rival search engine. The competitor has grown stronger since 2019 and has more than doubled its market share in search from 4% to 8.23% this March. By implementing Bing Chat and providing a sticky default browser for Windows, Bing has managed to become an acceptable alternative for people.

Statcounter: Desktop Search Engine Market Share

I should also mention two niche search engines: DuckDuckGo and Brave.search, both of which are seeing traction in some early-adopter communities that are looking for independent and privacy-oriented results. Both engines differentiate themselves by offering neutral and privacy-protected results to users. Further, as a browser, Brave offers additional protections such as tracking and ad blockers, resulting in some performance optimization. While DuckDuckGo partly uses Bing to index results, Brave has its own indexer and already provides a summarizer for some questions. Early adopters have a meaningless market share, but can be crucial in setting new trends.

Additionally, in 2012 Peter Thiel made a point about search, which is slowly materializing as stagnation of that segment:

“...Google is no longer a technology company, it's basically a search engine. The search technology was developed a decade ago. It's a bet that there will be no one else who will come up with a better search technology. So, you invest in Google, because you're betting against technological innovation in search.”

To this day, no-one has better search technology over Google, however the way search is conducted is changing from a list of results to natural AI responses. Given that some 60% of search queries are informational (requesting information), AI is well positioned to take market share from Google Search. Some of the more bullish analysts on Google’s rival - Microsoft, estimate (1, 2) that the peer can add between up to $100B in AI-driven revenue by 2027, partly citing a future growth in Bing market share.

Google’s Innovation Problem: 4D Or Structural Blind-Spots

Google has a list of at least 288 products and services that it has shut down after investing in their development. Most of these were high-tech bets on innovation or taking away market share from the competition.

However, the track-records of failed attempts leaves one wondering if the company has an inherent flaw in their business development process or is employing a barbell portfolio management strategy in product development (low-probability for high-returns as championed by traders like N.N. Taleb)?

In my opinion, even if they are going for the tail-end of the probability distribution to bet on high returns, what seems like a question of luck to a statistician, reveals blind spots of the business developers. There is something that doesn’t fit here, not only has the company failed on product development - something that is expected from startups, but it has repeatedly failed while having one of the largest distribution channels in the world.

An alternative view on this phenomenon is Peter Thiel’s take - that monopolies try to hide their power by demonstrating that they are just like everyone else and have the same difficulties competing with peers. This means that Google is spending money in order to keep regulators off its back, and should one of these small bets succeed, that’s just a nice bonus. But other than the cloud and the revitalization of its productivity apps - some products seem to have been engineered for anti-monpoly PR rather than success.

Therefore, while some investors are betting that the company’s “other bets” revenue line will generate performance through a few standout investments paying off big, I believe this is unlikely, and that that revenue line will continue to be cash burning bets.

Google Cloud Platform (GCP) Is The Right Bet On Infrastructure

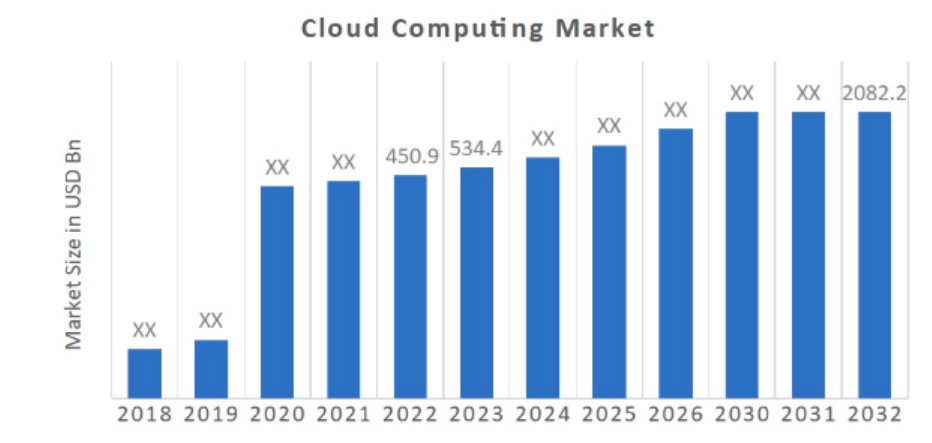

Google Cloud is a key vertical for Google, and its revenue share is likely to increase from the current 9.3% given it’sthe fastest growing segment for Google. This is driven by the fact that it still has a lot more market share left to capture, since the cloud market was valued at $619B in 2023.

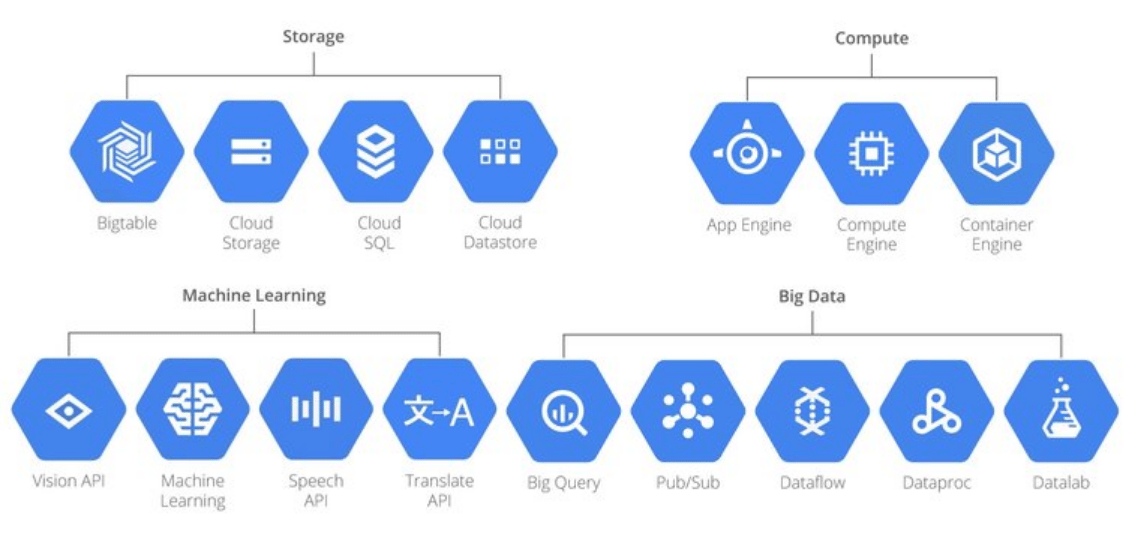

Cloud computing is becoming more popular as a cost effective, stable and secure solution for businesses. This has resulted in a trend of migrating software from on-premise to the cloud. The key Google Cloud services include virtual machines, databases, storage, machine-learning, networking etc. The ease of use, a well categorized list of services, quality customer support and the backing of Google’s infrastructure prime GCP for taking additional market share from peers. Google is also well integrated with SAP SE (1, 2), an enterprise resource planning system widely adopted by large companies.

This gives Google a foot in the door of all the companies that are using SAP, including more than 425k customers, holding a market share of 24% in the global ERP segment. Further, Google’s digital infrastructure is built with some of the deepest domain expertise, giving customers a competitive edge. From the perspective of Google, this move to Infrastructure as a Service (IaaS) solves the company’s “too much cash” problem, by allowing it to invest in capital intensive projects like their cloud services, which require a large amount of software and server infrastructure spending.

NGIS: Key Google Cloud Services

While Google Cloud faces serious competition from Microsoft Azure and Amazon Web Services (AWS), it is possible that the large cloud players will gang up on startups like Datadog and Snowflake and retain their leadership position. If the cloud turns out to be the right bet for companies, I think we will see large cloud providers behave like high-tech utilities that allow companies and users to plug-in to their infrastructure.

Industry Catalysts

The Cloud Will Grow, But We Shouldn’t Extrapolate

The cloud market is valued at $450B and is expected to grow to about $2T around 2030, representing a CAGR of 18.5%. While I see the need for growth in this segment, I believe that growth will diminish in the latter years of the forecast as cloud providers onboard most of the fitting large companies. The cloud is a hot segment at the moment, so we may be getting a bit exuberant on the projections, but my estimate is that it will start stagnating after it reaches a market share above $1.2T in the next 10 years.

Market Research Future: Cloud Computing Market Projections

There are a few reasons why I’m cautious on the $2T forecast, here is why:

- One can imagine that organizations with sensitive data will never join the cloud, no matter the quality of their security.

- Key cloud services will no doubt become cheaper as technology develops and competition rises, thus despite a growing user base, this will likely reduce revenue growth to a rate lower than the 18.5% expected from this industry.

- After companies rode the bandwagon of tech layoffs in the last two years, a lot of qualified engineers found themselves offering their services to new potential clients. Some of these people may use their domain knowledge to offer cheaper and replicable (open-source) alternatives that can be deployed on premise instead of the cloud. Additionally, the now lower cost of hiring software engineers (1, 2) may sway the cost-benefit analysis from starting projects that are deployed in the cloud to ones that are locally deployed. The challenge with on-premise deployment comes from the up-front costs of the hardware and software, but once a company has a working business model, they may be able to significantly reduce costs by migrating away from the cloud, e.g. the case study with Ahrefs.

- Finally, as with any new technology, not all projects work out, and we will have a much better understanding of what we can accomplish on the cloud and which are the use-cases that may not be a fit.

Hardware and Software Companies Poised to Benefit from AI Growth

The global AI market is projected to grow 39% annually and reach $357 billion in 2027. This growth is being driven by the increasing adoption of AI-powered solutions across a wide range of industries.

The two key beneficiaries of this growth are likely to be hardware manufacturers and software companies. Hardware manufacturers, such as NVIDIA, are making processing units that are specifically designed for AI applications. Software companies, such as Google, are integrating AI functionality into their existing offerings and developing new innovative technologies.

While LLMs are still in early development, it may be fair to say that they represent the second wave of AI, which has the potential to revolutionize the way we interact with devices. These developments will have the effect of producing services that cut expenses for companies, therefore shifting some of the costs associated with labor, to cheaper AI support. As well as increasing our productivity with innovation.

I predict that we will soon open a debate of where AI is going to move, and my sense is that the use cases will split into general, professional and specialized use. General AI includes search and Q&A, which will allow Google to keep its leadership as the “internet’s arbiter”. Professional AI includes the productivity suite e.g. office and CRM apps, where I expect Google to have difficulties producing services that stick and are profitable. Finally, I expect that Google Cloud will be a go-to service for developing specialized AI tools for industrial use cases and proprietary services by large corporations. While small and medium businesses may start relying on open-source models and cheaper alternatives.

Assumptions

- I assume that the stagnation in traditional search will continue, driven by a change in search behavior, higher utilization of in-app search instead of Google search, and a continuation of search engine decentralization led by Bing, but I also expect performance surprises from novel engines like Brave. I expect Google to benefit in the future on account of infrastructure optimization, increased ad & media monetization, and cost-cutting. For these reasons, I expect Google’s Services segment to grow slightly above the inflation rate, and forecast 8% annual growth over the next 5 years. This will increase the company’s segment revenue from $253.5B in the last 12-months to $372.5B in 2028.

- While I expect Google’s ads business to keep growing at a stable 8% rate, the cloud segment will likely increase as a portion of Google’s total revenues from the current 9.2% to 17.5% - given that it is still in the high growth phase. I expect Google’s Cloud Platform to onboard large customers at a variable but average growth rate of 25% over the next 5 years. This brings GCPs cloud revenue from $26.3B in the last 12 months, to $80.2B in 2028, a 3x increase.

- In total, I expect Google to grow around 10% annually in the next five years, when it will produce $460B in revenues.

- Despite pressures from peers, I assume that Google will be able to retain a steady net profit margin of 20%. With a base revenue of $460B in 2028, I expect the company to make $92B in net income, up by 57% from the $58.6B in the last 12 months.

- Google is executing a 2-year average share reduction of 2.3% annually thanks to its buyback programs. I expect this trend to pick up to an average of 2.5%, and the company’s share count to be reduced from the current 12.8B shares to 11.3B.

- As Google matures to a stable business, we will likely see investors growth expectations contract and consequently, the PE multiple will lower. Given the stock has had an average PE ratio of 29x over the last 10 years, an all time high of 57x in 2017 and lows of 18x last year, I expect that the stock will converge to a 20x PE multiple as it starts producing more returns and growth decelerates.

Risks

Government regulation

Alphabet, along with other tech companies, is facing increased scrutiny from regulators over issues such as privacy, data security, and anti-trust violations. If the company is found to exhibit more monopolistic characteristics, it could face legal action, and damage to its reputation. Conversely, because of this reason, Google is already having difficulties with M&A activities, and investors expect acquisitions to be harder and last longer. While government regulation tends to lag the zeitgeist, we can anticipate expedited regulation when companies are behind the laws that would have the indirect effect of enacting barriers to entry from new competitors.

Competition

Alphabet faces intense competition from other technology companies, such as Amazon, Apple, and Meta. If any of these companies launches a new product or service that significantly outperforms Alphabet's offerings, it could lead to a shift in market share. The company is constantly on the edge of the AI and cloud race with no established unfair advantages over large peers, except for Microsoft, which was revealed to have lower cloud revenues than believed and thus may be currently behind peers.

Tail-end cyberattack events

Google is a major target for cyberattacks. In 2017, it was the victim of a major cyberattack that attacked Google Cloud. The company mitigated the attack, but the risk remains that larger and more damaging events may occur in the future. A cyberattack could also disrupt Google's services, which could have a major impact on businesses and consumers around the world.

How well do narratives help inform your perspective?