Announcement on 20 May, 2024

The Roadmap Is Only Just Beginning

Intel's share price fell after the company disclosed financials for its fab business, then again when the company reported Q1 results, and yet again when new export restrictions were imposed. Neither of these developments really affect my longer term narrative, as the company’s new strategy and product roadmap are only just getting started. I’m more interested to know whether the product roadmap is on track.

The export ban does have a material impact in the short term, but isn’t significant for the longer term.

I’ll mention the results and foundry business briefly, and then what I’m keeping an eye on.

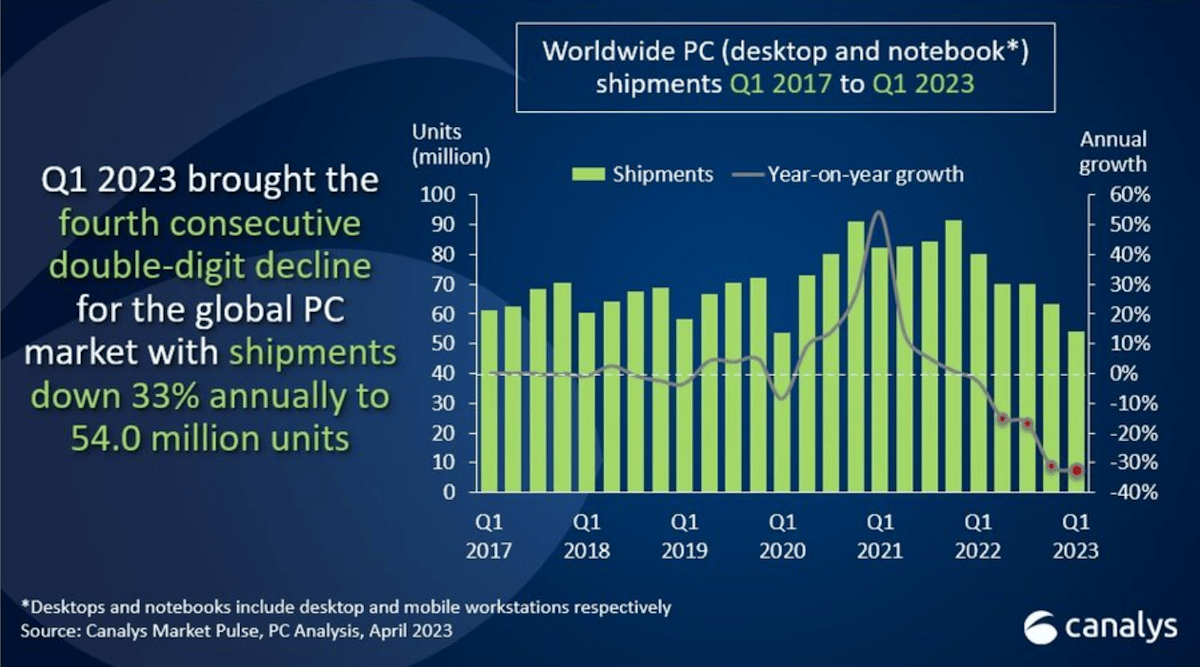

- The PC market has begun to recover, but more slowly than anticipated. Nevertheless, Intel’s Client Computing segment reported a 29% increase in revenue and a 100% increase in operating income.

- The Data Center segment reported a very small increase in revenue, with an improved operating margin. This segment is suffering as budgets have shifted to AI and GPUs.

- Networking and other segments were all down for the year, with demand in other chip markets remaining weak.

- The foundry business which is now reported as a separate segment reported lower revenue vs a year ago. This business signed several new clients last year, so sales should begin to increase over the next few years.

My initial narrative was focussed on the client and datacenter CPU segments, so the foundry business and other product lines don’t really matter as long as they aren’t burning cash. I think that in time one or more of these segments could become new growth drivers.

The schedule of new product launches appears to be on track, although there have been some capacity constraints with the Meteor Lake chip. Two more PC chips and one XEON server chip are due to be production ready by the end of this year. If all of that happens Intel will have a much more advanced line up going into next year.

On the client side:

- Global PC shipments rose 3% year-on-year in March. They were lower than the prior two quarters though there is some seasonality in this trend. This recovery should gather steam later in the year, unless there is a structural issue with PC demand.

- The delayed recovery could actually play into Intel’s hands, as they will have more advanced chips available. AMD is currently more competitive, and reported much higher sales growth for its client segment.

- The unknown factor for this segment is the adoption and market share of ARM CPU processors.

- Intel has a target of delivering 40 million AI PCs in 2024, which I think is a good benchmark to watch.

On the datacenter side, there are a few more unknowns:

- Budgets have shifted to AI and GPUs. Many analysts believe it will inevitably shift back to CPUs at some point, but time will tell.

- Intel says its soon to be launched Granite Rapids CPU can run 70 billion parameter models - we will see how that plays out in the market.

- Opinions are also mixed when it comes to Intel's Gaudi AI accelerators. For my narrative it would be a bonus if the Gaudi 3 is actually competitive with Nvidia or AMD processors.

There are quite a few unknowns at this point, but my narrative is based on incremental improvements in CPU sales, not on Intel making home runs across all product lines. In the last year the share price round tripped from $30 to $50 and back again while very little actually changed. I believe this shows that the market is only looking one to two quarters ahead.

I’m happy with my assumptions and valuations at this stage, though the narrative may well evolve later in the year.

Key Takeaways

- Market has low expectations for Intel due to a series of strategic errors in recent years.

- Market is underestimating Intel’s aggressive strategy to regain product leadership.

- Intel’s new processors will offer significant improvements in performance, efficiency and flexibility.

- These new product releases will coincide with an inevitable recovery in demand for CPUs.

- EPS will double in five years due to incremental improvements in demand, market share and margins.

Catalysts

Company Catalysts

Intel is back on the offensive

Intel lost its edge during the years prior to 2020 by playing defensively. This was a strategic error and the company is now going all out to correct it and reclaim product leadership.

Recent capital allocation decisions prove just how much Intel’s priorities have changed: Stock buybacks have been suspended and the dividend has been cut by 60%. Instead, Intel has spent $32 billion on R&D during 2021 and 2022. For context that compares to $5 billion at AMD and $7.4 billion at Nvidia during the same period.

The market is still focussed on how Intel’s current product lineup compares to AMD, and on Intel’s historic first quarter loss. Two years ago when CEO Pat Gelsinger took over he said the turnaround would take five years. Anecdotal evidence suggests that most of the key timelines are still in place and guidance for 23Q2 was recently raised.

A roadmap to reclaim product leadership and market share

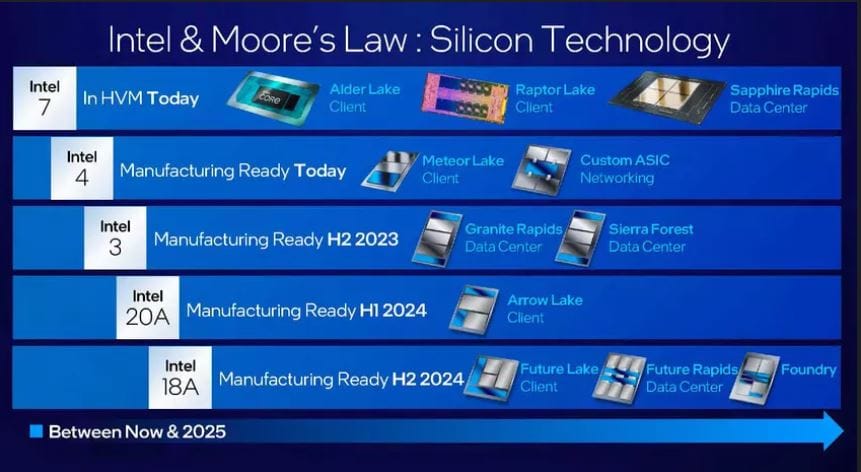

Intel’s roadmap to 2026 will not only make it competitive with AMD, but offer customers more choice and flexibility. As Intel progresses through 5 process nodes it will also be introducing an entirely new, flexible and efficient architecture.

Source: Electronics Weekly

PC and Mobile Processors

Raptor Lake (in production since late 2022) is the latest core CPU using Intel’s 7nm process. Though the architecture is similar to the Alder Lake CPU, increased core counts have resulted in improved performance.

Meteor Lake (due H2 2023) will be the first core CPU using the Intel 4 process. It will also be the first processor built using Intel’s new tiled architecture which stacks separate components (including components from other manufacturers) to create a single chip.

This modular approach means Intel can mix and match components from different process nodes and manufacturers to create processors for specific market segments. It will also be able to react to changing demand trends relatively quickly.

Arrow Lake (due 2024) will be the first chip from the Intel 20A (~ 2nm) process. With this generation of processors, Intel will be using a new transistor architecture and a new power delivery scheme. The new design and higher density will translate to significantly improved performance and power efficiency.

Arrow Lake will also include a substantially more powerful 3nm iGPU which will make all but the most powerful discrete GPUs unnecessary.

Lunar Lake (due 2024) will be Intel’s first chip from the 18A (~1.8nm) process. These processors will offer ultra low power performance and are being developed in partnership with OEMs specifically for lightweight, ultra-thin devices.

Datacenter Processors

Intel’s XEON datacenter processors will follow a similar series of architecture changes, and include an additional node (3nm). The next four generations of the XEON chip are:

- Intel 7: Emerald Rapids (due Q4 2023)

- Intel 3: Sierra Forest (due H1 2024)

- Intel 3: Granite Rapids (due H2 2024)

- Intel 18A: Clearwater Forest (due 2025)

Complementing the CPUs are Intel’s Gaudi2 processors designed for deep learning and inference, and currently used at Amazon AWS.

The new and improved value proposition

Intel’s x86 product list is going to be completely transformed over the next three years:

- Intel will be able to compete with AMD on performance and efficiency at each price point.

- Intel will then have the flexibility to help OEMs meet end user needs with any combination of price, power efficiency, performance and graphics capabilities.

- The improved GPUs will allow OEMs to remove discrete GPUs on some devices, thereby lowering costs.

- The ultra low power performance chips require smaller batteries, so OEMs will be able to build thinner and/or cheaper devices.

This new proposition will allow Intel to comfortably reclaim 5% market share from AMD by 2027 - and possibly quite a bit more.

The narrative could improve considerably

80% of Intel’s revenue comes from the client (50%) and datacenter (30%) segments. The remaining segments are unlikely to move the needle in the next five years, but could become game changers beyond 2027.

Intel Foundry Services: Intel has an ambitious goal of becoming the world’s second largest foundry by 2030, and manufacture chips for other leading chip companies. To do this it intends to eventually invest up to $100 billion in partnership with the government and other investors. Seven new fabs are currently being built in the US. Germany and Ireland, four of which are dedicated to 18A and 20A processes.

IFS is now on a revenue run rate of ~$500 million which will increase by about $1.5 billion with the recent acquisition of Tower Semiconductor. It’s unlikely to contribute meaningfully to total revenue by 2027, but could contribute very meaningfully to the picture after 2027.

If Intel’s new architecture proves to be successful, it will have a proprietary and flexible process to offer to fabless semiconductor makers, as well as companies like Apple that are developing their own chips. In addition, it will offer chipmakers the opportunity to diversify their production away from TSMC and Samsung.

Mobileye: Intel owns 94% of the autonomous driving and driver-assistance technology company. Mobileye has partnered with many of the leading automakers and is already showing strong growth and has two new level 4 ADAS (advanced driver sssistance systems) products due in the next two years.

Revenue could actually become meaningful for Intel by 2027, but margins would probably be low. Beyond 2027 Mobilye could become a significant growth engine.

GPUs, IoT, FPGAs, networking and edge computing: Intel sells dozens of other products, mostly in growing markets. There are no obvious catalysts likely to lead to standout performance from these products in the short term. But each of these product categories could turn into a major opportunity down the line - ie, they add optionality to the investment case.

Industry Catalysts

A cyclical rebound in CPU demand

PC sales and demand for CPUs in general fell in 2022 and the first half of 2023. This was the result of sales being pulled forward during the pandemic: Companies upgraded PCs to allow employees to work remotely, consumers upgraded their own PCs for gaming, and data centers were expanded to support cloud growth.

Semiconductor inventories also increased as companies over-ordered to counter supply chain bottlenecks.

PCs are typically replaced every 3 to 6 years, so a new replacement cycle will need to occur over the next few years. At the same time, inventories are now being drawn down which will soon lead to accelerating demand. Much of the current focus is on AI investment for data centers - but this will still need to be complemented with CPUs.

Source: Semiconductor Engineering

A cyclical recovery in demand is now inevitable in the next few years, just as Intel rolls out four new generations of processors.

Onshoring and the ‘TSMC risk’

The US and EU are providing funding and incentives to companies building fabs in the US and Europe. This is being done to reduce reliance on ‘geopolitically at risk’ TSMC and bring manufacturing jobs back to the US and Europe. Intel is probably the biggest beneficiary of capitalizing on the opportunity.

Besides the subsidies and incentives, this also makes Intel a compelling partner for OEMs wanting to support these initiatives and secure their own supply chains.

Assumptions

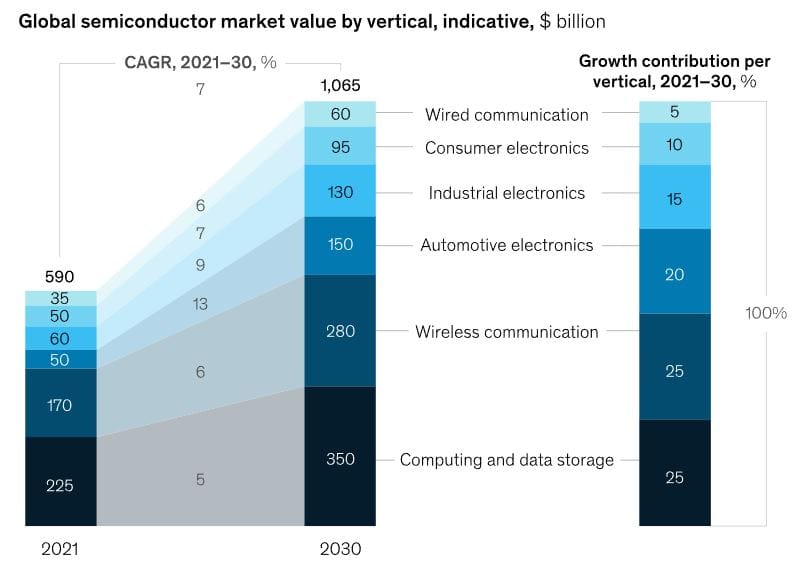

Global CPU sales rebound from 2024 to 2027:

The inevitable rebound in CPU demand will result in industry wide sales increasing at 7% between 2024 and 2027. This compares to forecasts for the 2021 to 2030 period that average around 5%.

Intel wins back 5% market share from AMD:

Intel’s product range will become increasingly more competitive as the Intel 4, 3, 20A and 18A products are released. Customers will also be keen to diversify their supply chains in light of the TSMC risk.

The market will be eagerly anticipating the new product launches, which will serve as a catalyst for accelerating sales volumes. Intel should therefore be able to win back 5% of the market from AMD.

Revenue increases to $91 billion for FY2027:

Intel’s revenue for the datacenter and client segments should comfortably grow at 8.5% a year due to the 7% market growth and 5% market share gains. This will bring revenue for the two segments to $75 billion for 2027. I’m assuming revenue for the remaining segments will increase at 5% a year to reach $16 billion. So Intel’s total revenue for 2027 will be $91 billion.

Net profit margin reaches 22%:

Intel has a long term operating margin goal of 27 to 33%, while its average net margin over the last 10 years was 20.2%. The company is already cutting costs in some areas, and after 2025 will be able to reduce R & D spend relative to revenue. With accelerating revenue growth and cost increases slowing, the net profit margin will be at least 22%.

EPS will reach $4.8 by 2027:

Assuming the share count remains unchanged, $91 billion in revenue and a 22% net profit margin means EPS will be $4.80 in 2027. This will be a 150% increase from the $1.92 Intel earned for FY2022.

Risks

There are several risks that could derail my narrative:

Execution risk

Intel has had numerous production delays in recent years. It does seem that the company is now more focussed and managing to stay on track, but the risk is still real. While I don’t believe these risks are that high, they’re worth keeping mind for an understanding of probabilities, and expectations

The balance sheet, funding and debt:

If Intel's turnaround is delayed, the company’s financial health would become an issue. I’ll be monitoring their project execution timeline, and seeing how the company’s balance sheet and debt affordability travels as things develop.

Industry growth

Forecasts for the growth of the digital economy including cloud software, AI, gaming etc are quite optimistic. If these trends lose momentum, the entire hardware sector will be affected, including Intel.

AI and GPUs

There is some speculation that AI will eventually make CPUs obsolete in data centers as workloads move to GPU powered algorithms. I believe Intel is positioned within the industry to navigate these risks should they become more likely and or more prominent.

How well do narratives help inform your perspective?