PAYX Stock Overview

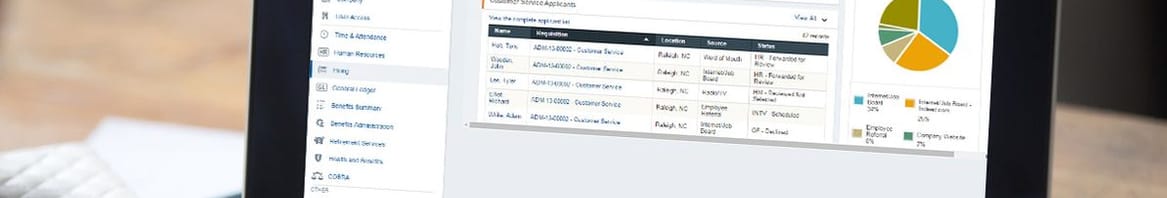

Provides integrated human capital management solutions for human resources (HR), payroll, benefits, and insurance services for small to medium-sized businesses in the United States, Europe, and India.

| Snowflake Score | |

|---|---|

| Valuation | 4/6 |

| Future Growth | 2/6 |

| Past Performance | 5/6 |

| Financial Health | 6/6 |

| Dividends | 5/6 |

Paychex, Inc. Competitors

Price History & Performance

| Historical stock prices | |

|---|---|

| Current Share Price | US$116.17 |

| 52 Week High | US$129.70 |

| 52 Week Low | US$106.27 |

| Beta | 0.99 |

| 11 Month Change | -5.23% |

| 3 Month Change | -8.23% |

| 1 Year Change | -0.27% |

| 33 Year Change | 4.03% |

| 5 Year Change | 35.51% |

| Change since IPO | 66,889.59% |

Recent News & Updates

Paychex: A Model Of Consistency

Jul 07Paychex, Inc. (NASDAQ:PAYX) Annual Results: Here's What Analysts Are Forecasting For This Year

Jun 28Paychex: Uncertainties Ahead Are Keeping Me On The Sidelines

Jun 21Recent updates

Paychex: A Model Of Consistency

Jul 07Paychex, Inc. (NASDAQ:PAYX) Annual Results: Here's What Analysts Are Forecasting For This Year

Jun 28Paychex: Uncertainties Ahead Are Keeping Me On The Sidelines

Jun 21Is Now The Time To Look At Buying Paychex, Inc. (NASDAQ:PAYX)?

Jun 03Paychex (NASDAQ:PAYX) Will Pay A Larger Dividend Than Last Year At $0.98

May 04Here's Why We Think Paychex (NASDAQ:PAYX) Might Deserve Your Attention Today

Apr 28Paychex: Scoop Up This Dividend Growth Stock Now

Apr 10Paychex, Inc. (NASDAQ:PAYX) Just Reported Third-Quarter Earnings: Have Analysts Changed Their Mind On The Stock?

Apr 04Paychex (NASDAQ:PAYX) Might Become A Compounding Machine

Apr 02Are Investors Undervaluing Paychex, Inc. (NASDAQ:PAYX) By 29%?

Mar 21Paychex: A Wonderful Business, But Waiting For A Better Entry Point

Mar 21Should You Think About Buying Paychex, Inc. (NASDAQ:PAYX) Now?

Feb 14Paychex: A Dividend Grower Priced At A Discount

Feb 12Paychex, Inc. (NASDAQ:PAYX) Investors Are Less Pessimistic Than Expected

Jan 21Paychex, Inc.: Cash Generating Machine Trading At Cheap Valuation

Jan 17Capital Investments At Paychex (NASDAQ:PAYX) Point To A Promising Future

Dec 27Here's Why Paychex (NASDAQ:PAYX) Has Caught The Eye Of Investors

Dec 15An Intrinsic Calculation For Paychex, Inc. (NASDAQ:PAYX) Suggests It's 24% Undervalued

Oct 20Capital Investments At Paychex (NASDAQ:PAYX) Point To A Promising Future

Sep 26With EPS Growth And More, Paychex (NASDAQ:PAYX) Makes An Interesting Case

Sep 13At US$122, Is It Time To Put Paychex, Inc. (NASDAQ:PAYX) On Your Watch List?

Aug 30Calculating The Intrinsic Value Of Paychex, Inc. (NASDAQ:PAYX)

Jul 16Paychex (NASDAQ:PAYX) Will Want To Turn Around Its Return Trends

Jun 19Here's Why Paychex (NASDAQ:PAYX) Has Caught The Eye Of Investors

Jun 07Should You Think About Buying Paychex, Inc. (NASDAQ:PAYX) Now?

May 01Calculating The Fair Value Of Paychex, Inc. (NASDAQ:PAYX)

Apr 06Returns On Capital At Paychex (NASDAQ:PAYX) Paint A Concerning Picture

Mar 13Here's Why We Think Paychex (NASDAQ:PAYX) Might Deserve Your Attention Today

Feb 27Estimating The Fair Value Of Paychex, Inc. (NASDAQ:PAYX)

Jan 04Returns On Capital At Paychex (NASDAQ:PAYX) Paint A Concerning Picture

Dec 10Here's Why We Think Paychex (NASDAQ:PAYX) Might Deserve Your Attention Today

Nov 16Paychex declares $0.79 dividend

Oct 13Paychex Q1 2023 Earnings Preview

Sep 27Paychex, Inc.'s (NASDAQ:PAYX) Intrinsic Value Is Potentially 33% Above Its Share Price

Sep 26Paychex: Expensive Stock, But The Options Market And Chart Present A Bullish Opportunity

Sep 13Should You Investigate Paychex, Inc. (NASDAQ:PAYX) At US$127?

Sep 12Shareholder Returns

| PAYX | US Professional Services | US Market | |

|---|---|---|---|

| 7D | -0.7% | 0.4% | 1.8% |

| 1Y | -0.3% | 1.0% | 23.7% |

Return vs Industry: PAYX underperformed the US Professional Services industry which returned 1% over the past year.

Return vs Market: PAYX underperformed the US Market which returned 23.7% over the past year.

Price Volatility

| PAYX volatility | |

|---|---|

| PAYX Average Weekly Movement | 3.0% |

| Professional Services Industry Average Movement | 4.8% |

| Market Average Movement | 5.7% |

| 10% most volatile stocks in US Market | 14.7% |

| 10% least volatile stocks in US Market | 2.8% |

Stable Share Price: PAYX has not had significant price volatility in the past 3 months.

Volatility Over Time: PAYX's weekly volatility (3%) has been stable over the past year.

About the Company

| Founded | Employees | CEO | Website |

|---|---|---|---|

| 1971 | 16,000 | John Gibson | www.paychex.com |

Paychex, Inc. provides integrated human capital management solutions for human resources (HR), payroll, benefits, and insurance services for small to medium-sized businesses in the United States, Europe, and India. It offers payroll processing services; payroll tax administration services; employee payment services; and regulatory compliance services, such as new-hire reporting and garnishment processing. The company also provides HR solutions, including payroll, employer compliance, HR and employee benefits administration, risk management outsourcing, and the on-site availability of a professionally trained HR representative; and retirement services administration, including plan implementation, ongoing compliance with government regulations, employee and employer reporting, participant and employer online access, electronic funds transfer, and other administrative services.

Paychex, Inc. Fundamentals Summary

| PAYX fundamental statistics | |

|---|---|

| Market cap | US$42.33b |

| Earnings (TTM) | US$1.69b |

| Revenue (TTM) | US$5.28b |

24.7x

P/E Ratio7.9x

P/S RatioIs PAYX overvalued?

See Fair Value and valuation analysisEarnings & Revenue

| PAYX income statement (TTM) | |

|---|---|

| Revenue | US$5.28b |

| Cost of Revenue | US$1.48b |

| Gross Profit | US$3.80b |

| Other Expenses | US$2.11b |

| Earnings | US$1.69b |

Last Reported Earnings

May 31, 2024

Next Earnings Date

n/a

| Earnings per share (EPS) | 4.69 |

| Gross Margin | 71.97% |

| Net Profit Margin | 32.03% |

| Debt/Equity Ratio | 21.5% |

How did PAYX perform over the long term?

See historical performance and comparison